A Tale of Two Sports

Last March, I wrote about the rise of NBA Top Shot and attempted to price the nascent digital collectible. At the time, I used a simple heuristic for the basis of my price estimate.

Price (Rarest Baseball Card) * Prob (Top Shot mass adoption) = Price (Rarest Top Shot Moment)

In my previous blog post, I had given NBA Top Shot a ~4% chance of long term success, and thus valued its rarest card at $100,000–effectively 4% of the price of a Mickey Mantle baseball card. Since that blog post, the value of Top Shot Moments shot up in spectacular fashion and then collapsed equally as spectacularly. That probability today is likely lower than 4%.

A year later, as the world sobers up to a “crypto winter”, Top Shot seems like yet another case study of web3 gaming: the story of another speculative bubble bursting. It’s no wonder some people are starting to wonder whether the whole industry has a leg to stand on. We might have come to the same conclusion, if it were not for the success of another title.

At the same time that Dapper launched NBA Top Shot, another company — Sorare -– also launched their collection of digital soccer cards. Top Shot and Sorare shared a lot similarities: both sold tokenized sports cards, both licensed from top tier sports (NBA, and T1 soccer leagues), both launched around the same time (early 2021), both tiered their cards and had seasonal systems, both courted non-crypto fans through direct payments, and so on.

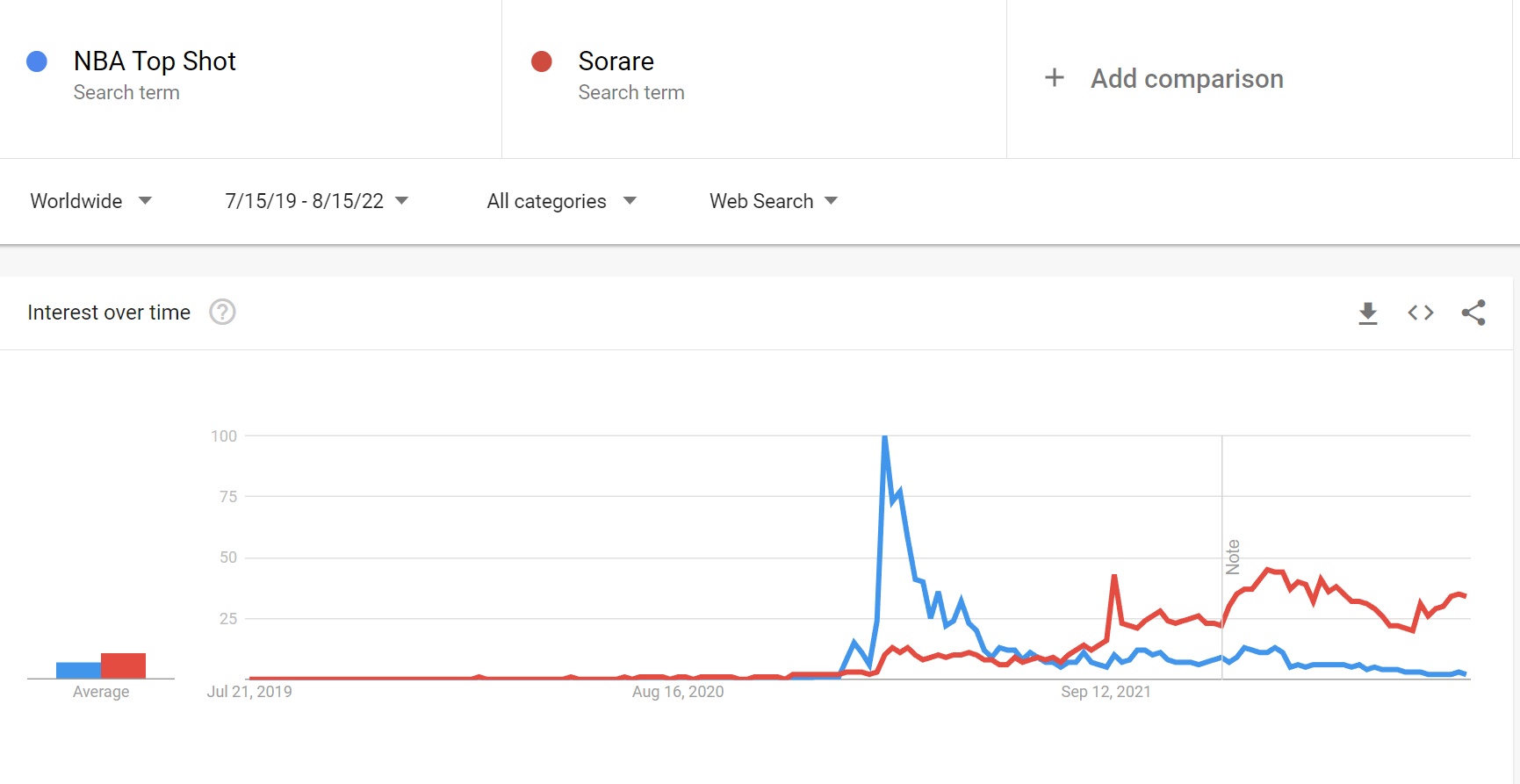

In fact, Top Shot and Sorare looked so similar at first glance, they should have experienced very similar fates. But that did not happen, as the below Google Search Trends shows.

Whereas Top Shot search interest (and accordingly its price) saw the familiar “shark fin” pattern of death common to many crypto projects, Sorare continues to grow. Interest in Sorare is higher today than in the bubbly days of late 2021.

What led to such divergence? Why did two seemingly identical products end with such different outcomes? This article will explore these questions in depth— and specifically look at what Sorare got right.

Catching fire (of the wrong kind)

Of the two collectibles, NBA Top Shot was the first to catch fire. In February of 2021, partially through the market conditions and partially through its own efforts, NBA Top Shot catapulted into the mainstream. Its most popular cards surged from a few hundred dollars to hundreds of thousands. The insane price action caught the imagination of both collectors and media, which amplified the news. In hindsight, Top Shot itself also fanned the flame, advertising on Twitter and elsewhere when new card sale records get broken—sowing the seeds for media pickup and public imagination.

People began to chase: as the most sought-after cards became more expensive, other cards also pushed higher in secondary markets. In the primary market, Top Shot sold its cards in packs for a fixed price and in limited quantities. As the value of cards increased in the secondary market, primary packs became more sought after. A buyer could theoretically buy a primary pack, open it up, and immediately flip the cards in the secondary market for a healthy profit. It was effectively arbitrage, and it didn’t go unnoticed. As word spread of the riskless money-making opportunity, speculators and bots alike crashed Top Shot’s waitlist. Suddenly millions of people wanted to buy Top Shot packs.

In response, Top Shot increased the supply of its primary packs to satisfy demand and drive revenue. But of course, as we know from the time of the Tulip Bubble, nothing speculative lasts forever. As supply of new cards eventually caught up to speculative demand, the steam of ever-increasing-prices ran out, and the roller coaster began to nose dive. Speculators are not long term holders, and declines in price drove more to sell, which precipitated further price drops. Suddenly supply vastly outstripped demand, and the whole thing fell apart—to the point where even true believers panicked and lost confidence.

Things always look clearer in the rearview mirror. In hindsight, I argue that Top Shot made three mistakes. First, Top Shot fanned the flames of speculation to drive more engagement. Second, Top Shot compounded that speculative fervor with its pack system, which for a time offered arbitrage opportunities for the purchases. This in turn changed the profile of buyers from basketball fans to pure speculators. Finally, and I argue most crucially, Top Shot mistook that speculative demand for true product-market fit, and leaned into it.

The prudence of Sorare

Compared to the roller coaster ride of Top Shot, Sorare seemed almost boring. It did not advertise the sales of its most valuable cards to draw attention, and in its low-profile avoided the worst of the speculative behaviors. Sorare also sold new cards individually to the highest bidder rather than in supply-limited packs— which meant supply met with demand efficiently for each primary card sale, and no arbitrage existed. When arbitrageurs looked for easy money, they turned elsewhere.

These decisions may seem like strokes of good luck, but I’d reason otherwise. As we continue to dive into the Sorare model, it becomes more clear that Sorare’s decisions come from a place of quiet confidence: a deep understanding of what they’re building, why, and who their real customers are.

Unlike Top Shot, Sorare is also a game. Players pick lineups of five players (and a captain) into various competitions, and the performances of the real players during that time period determines the scoring— not unlike traditional fantasy sports. Winners across each competition are rewarded with new cards and cash winnings.

As such, Sorare’s core loop was not about opening packs to find extra rare cards, but rather scouring the primary and secondary markets for undervalued individual players with potential, buying these players for cheap, and then placing these players in the right configuration. The prerequisite of engaging in this loop is a deep understanding of soccer.

Though Sorare is built on Ethereum and technically tradeable on public marketplaces like Opensea, Sorare sidesteps this by building its own marketplace– not to collect fees (as its marketplace charges nothing) but to better the trading experiences of its players. Players can list their cards on the Sorare website and in turn scour for deals, by player and rarity. Players can also privately message other players to set up side deals, including trading NFT for NFT (a Pulisic and some cash for a Ferran Torres, perhaps). This mirrors real trades in the soccer world, and further increases the immersion of the game. Building its own marketplace also allowed Sorare to avoid vanity metrics associated with public marketplaces— such as the price action of floor prices.

Floor prices mean nothing to Sorare’s model. At some point over the past year, Sorare introduced a lower tier of cards called “Uncommons” to accommodate for the increasing volume of players. By public metric, these uncommon cards decreased the floor prices of the Sorare collection. In reality, they allowed for more players to come onboard at lower prices. Rather than needing to justify their actions, Sorare sidestepped this conversation altogether.

The Sorare onboarding process is similarly ingenious. When new players sign up, they receive a set of common cards that behave like every other card, and which the new players can immediately start playing with (albeit in the training leagues). Players receive more free common cards as they continue to play. Only through more research do we find out that these cards are not tokenized and not tradeable, and so are worthless financially. They are there for new players to learn the game, and to induce players towards spending when they are ready.

Three things about this experience stands out: first, it creates a free first-time-user-experience without destroying the integrity of its market economy. This type of onboarding is often practiced in free-to-play gaming, but rarely seen in crypto projects. Second, Sorare’s first-time-user-experience ingests players who actually want to play the game, and not speculators who want to flip things. Third, its common card system blurs the lines between tokenized assets and non-tokenized assets.

And here is the crux of the Sorare philosophy. It treats blockchain as yet another technology that enables a particular consumer use case— the digitization of the soccer manager experience. It does not concern itself with lofty philosophical goals like open interoperability or community-based decentralization. Nor does it pander to the insular crypto culture that grew to surround the technology. It builds on-chain where it makes sense to, and off-chain as it betters the user onboarding experience— all in the service of its core player base of soccer aficionados. In short, it is a true consumer business—a rarity within web3.

Sorare is succeeding thus far. Its growth in interest and players are due to real demand, rather than speculative fervor. That such a model can be stood up should be no surprise. After all, trading cards already exist in the physical world. There’s no reason to believe it can’t be done digitally.

Many concepts in web3, like limited pack sales, NFT whitelists, and community token pre-sales, are actually more or less the same thing— tools for driving speculative demand. As the examples of Top Shot and Sorare demonstrate, speculative demand does not equal true product market fit (and actually often masks it), and can be very dangerous over the long run. Sorare’s ability to parse through the noise to build a successful consumer business is almost singular among the crowd.

The diverging paths of Top Shot and Sorare also point to another observation: tokenization of digital assets (in gaming or otherwise) is neither a death knell nor a panacea. It is simply a tool that enables new consumer use cases that did not previously exist. The important thing is to know what those use cases are and who you’re serving, build towards those, and ignore the noise.